Cut into the fast lane

Our comprehensive range of services

On your path to the future of asset management, we will support you with a comprehensive range of services. SwissComply is your external specialist who covers all your compliance, risk management and legal needs. In addition to “outsourcing” and “approvals”, our range of services also includes numerous advisory services such as the FinSA/FinIA assessments.

Compliance & Risk Management build client trust

We provide you with a personal risk & compliance officer

Individual modules of our compliance & risk management services

The Challenge

Switzerland is fundamentally revising its financial market legislation in order to harmonize it with European standards. The two new laws – the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) – were passed by the Swiss parliament. The FinIA will regulate the approval and organizational requirements as well as the internal processes, while the FinSA will define detailed rules for financial institutions when providing services to their clients in all phases. This is accompanied by the requirement of an independent compliance and risk management function. Implementing all requirements of the new regulation poses major challenges for independent asset managers in particular.

The Solution

SwissComply provides you with a personal compliance & risk manager (outsourcing or body lending) who continuously monitors compliance with regulatory guidelines and supports you with their implementation. Furthermore, standardized processes are an important basis for effective risk minimization and at the same time ensure the necessary investor protection. SwissComply fully covers compliance and risk management throughout the entire life cycle of the client relationship, thus enabling high-quality asset management.

Your Advantages

- We make sure you are in compliance with regulatory requirements at all times. This way you can justify the confidence of clients and arm yourself against business risks due to unintentional breaches.

- You get cost-effective access to established specialists with many years of experience in the areas of compliance, risk management and legal and thus save investments in your own resources.

- We have precise knowledge of the requirements of the supervisory authority and comprehensive knowledge of upcoming regulatory changes.

- We pursue practice-oriented solutions tailored to your needs, so that you do not receive theoretical concepts, but solutions suitable for everyday use.

- Your legal setup is future proof, you can focus on your core competencies and capture growth opportunities.

- In case of absence of compliance and risk managers (e.g. dismissal, illness or accident), you can quickly access specialists as part of a body lending to overcome temporary staff shortages.

- We always offer you a high quality of service, open communication and strive for a long-term partnership with you.

- All listed services can also be obtained as pure consulting services.

Make your business fit for the future. We would be happy to advise you in more detail on the subject of outsourcing.

Online trainings (PDF) LCR services (PDF) Startup package (PDF)Approvals will get you ahead

We take over the entire coordination of the approval process for you and act as point of contact for FINMA or the SRO.

Individual modules of our services in the field of supervisory approvals

The Challenge

Like the Collective Investment Schemes Act (CISA), the new Financial Institutions Act (FinIA) also provides for an approval requirement. While the CISA regulates the approval requirements for asset managers of collective investment schemes (asset managers), the FinIA defines the approval requirements for all independent asset managers.

When applying for a supervisory approval, you will be confronted with various challenges. The increasing density of regulation and various conditions imposed by FINMA may make the approval process even more difficult. Furthermore, you need to apply for your approval as quickly as possible so that you can conduct business (again) as soon as possible.

The Solution

SwissComply supports you throughout the entire incorporation and approval process. You will be supported by a team of specialists from all relevant areas (compliance, legal, risk management, IT, audit) with many years of practical experience. We have detailed knowledge of the requirements of FINMA and the SROs, as well as comprehensive know-how of upcoming regulatory changes and support various forms of approvals. SwissComply is a company with straightforward structures that is therefore able to offer great flexibility and a high-quality support package in the area of supervisory approvals – tailored to your individual needs.

Your Advantages

- You can be sure that your incorporation or approval application will comply with the regulatory requirements.

- You will be supported by a proven team of specialists with extensive experience in the field of approval applications.

- We assure you that your application will be processed and submitted to the competent authority as quickly as possible.

- SwissComply not only takes over the coordination of your application but acts as point of contact for FINMA or SRO.

- We provide you with all relevant documents needed for incorporation or for submitting your application for approval.

Go one step further and create more value for your company and build client trust. We will be happy to advise you in more detail on the subject of supervisory approvals.

Approval support (PDF) Contact us now

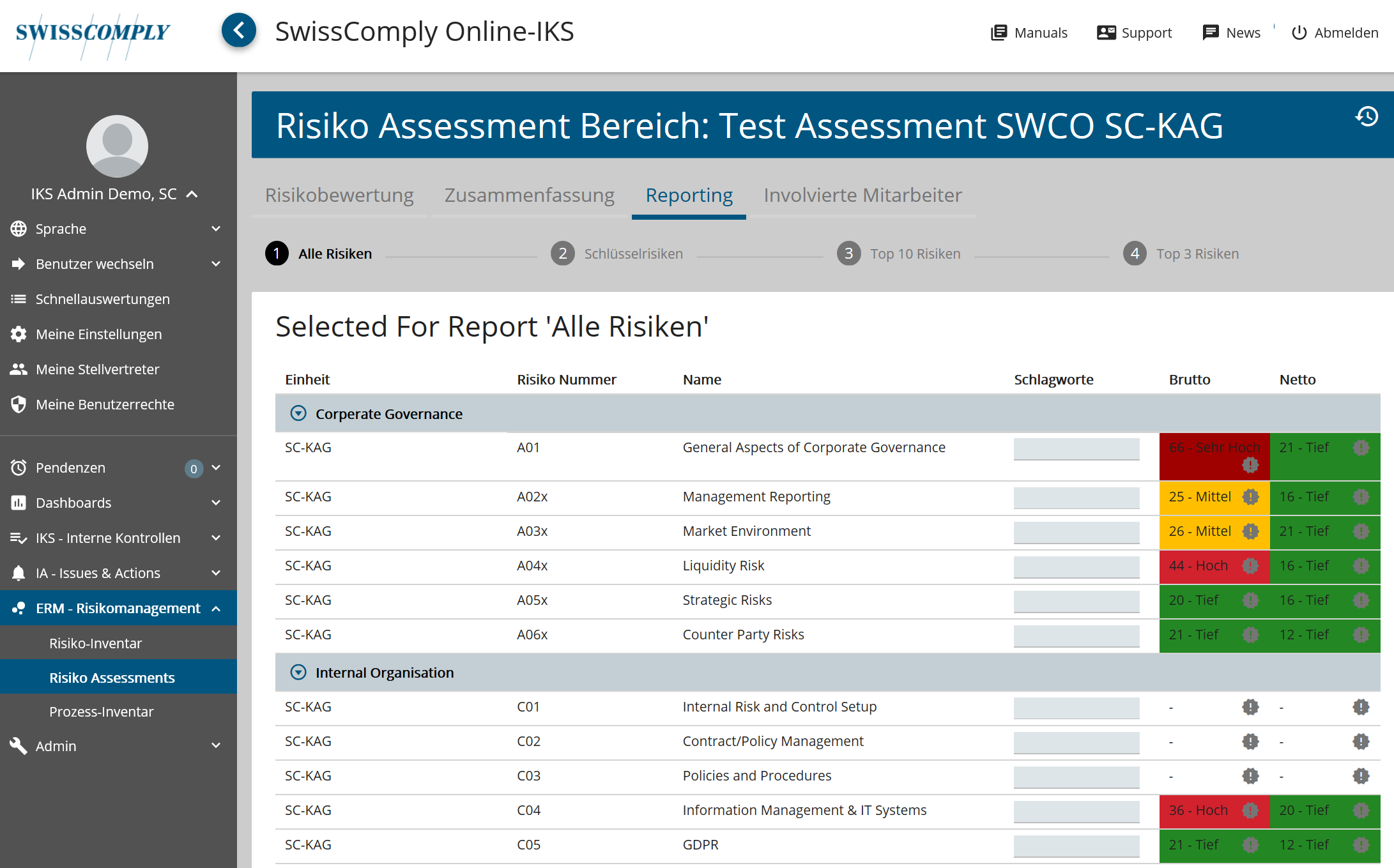

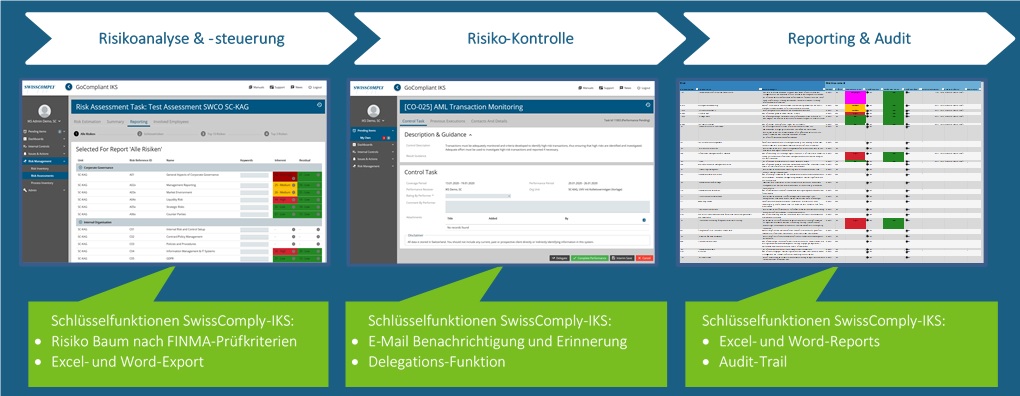

ONLINE-ICS – EFFICIENT, FOCUSED, FINIA-SUITABLE

Why is an internal control system (ICS) needed?

The obligation to introduce an ICS is not an invention of FinIA (Financial Institutions Act), which came into force in January 2020. The Swiss Code of Obligations has for some time required larger Swiss companies to implement an ICS as a risk management tool (Art. 728a). The CISA (now the FinIA) also explicitly prescribed the requirement of an effective ICS for asset managers of collective assets. With the FinIA, this obligation is now extended to all prudentially supervised financial service providers (regardless of size and business model).

In addition to this regulatory requirement (without an effective ICS, the FINMA licence will not be granted), it should not be forgotten that with the ICS, the management and board of directors have a valuable tool at their disposal to systematically identify risks in their company and to counter them in a timely and effective manner through control activities.

The online ICS of SwissComply at a glance

- Efficient annual risk analysis and control along predefined (and expandable) risk dimensions

- Risk control function with automatic e-mail notification and reminder

- SwissComply Standard Risk & Control Set with all necessary risk dimensions and controls, which are constantly adapted to changing regulatory requirements

- Dashboard for designated risk managers/managing directors (with statistics and reporting functions)